“The border is frozen, but the balance sheet is warm.” These words encapsulate the current India-China situation, characterized by a border standoff, yet trade between the two countries continues to flourish as if nothing has changed. Despite icy diplomatic relations and border tensions in the Himalayas, the economic pipeline between India and China is hotter than ever. As we move through 2026, India is tightening visa rules, yet Indian industries are buying Chinese machinery at record rates. The future of this relationship isn’t signalling “decoupling”, it’s about a high-stakes balancing act between dependency and diversification.

Trade Overview and Numbers

India is not only facing aggression from China on the border, but it is also facing a $100 billion trade deficit that India has with China in FY 25. India’s trade deficit with China alone is now larger than the total GDP of countries like Sri Lanka or Luxembourg.

India imports goods from China.

This data only displays the macro image of India-China trade relations, the exchange relation is more one-sided and penetrated than it looks. One of the most dangerous misconceptions is that the deficit stems from cheap plastic toys or Diwali lights. India is importing oxygen for its own industrial growth. Four critical categories account for nearly 80% of our imports:

According to the data from the last financial year, India imported nearly $38 billion worth of electronics goods from China, which includes critical electronics components such as integrated circuits, laptop components, and mobile phone parts, serving as fuel for the “Make in India” assembly lines.

India also imported heavy machinery, including industrial transformers, boilers, and the equipment needed to build factories worth nearly $26 billion.

The pharma sector, regarded as a source of pride for Indian manufacturing capabilities, heavily relies on China for raw materials, particularly Active Pharmaceutical Ingredients (APIs), which are essential for India’s renowned generic drug industry.

China also contributes to the dream of a green fuel-based India by supplying important ingredients such as PV cells, solar panels, nuclear reactors, boilers, and lithium, which is considered the fuel of the future.

India Exports to China.

As we saw in the previous section, China exports high-value goods to India, but the same is not true for India’s exports to China.

One of the biggest exports to China from India is iron ore; it includes products like ore, slag, and ash. This product is very volatile when China’s construction sector slows down, and Indian iron ore exports plummet.

India exports nearly $8 billion worth of seafood to the world, out of which $1.3 billion goes to China, which makes China the second- largest export destination after the USA. There were times when Beijing often suspended seafood shipments overnight, citing “quality checks” or “virus traces” as a diplomatic pressure tactic.

Petroleum products and organic chemicals are also major exports from India to China; the major export items in these segments are light naphtha and organic chemicals. The total worth of these goods lies around $1.2 billion.

In terms of cotton and spices, India has been one of the preferred destinations for the world, and China is also no different from it. India has supplied over $430 million worth of cotton and $670 million worth of spices, tea, and coffee. However, China has recently moved its textile sourcing to Vietnam and Bangladesh, causing a sharp dip in Indian cotton exports.

Indian problem

India, as a country, faces numerous problems in the global trade arena, ranging from tariffs to bans, regulatory issues to quality control problems, as well as heavy gold imports and foreign reliance on oil imports. However, are there any problems that India has not yet permanently solved? Some of these problems are discussed below.

Industry Laziness

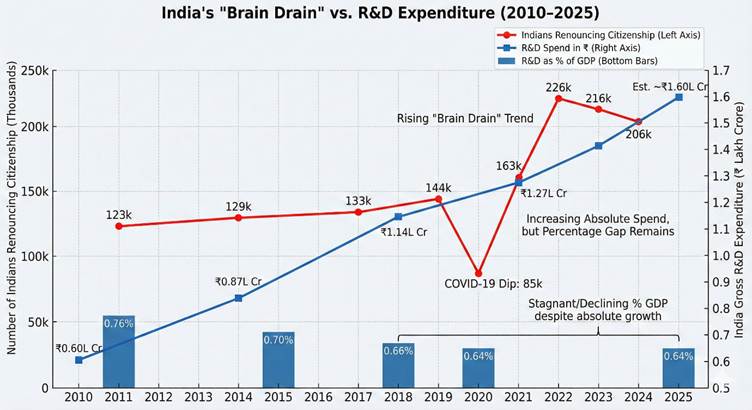

For decades, a significant segment of the Indian industry has fallen into what experts call “import inertia,” a comfortable reliance on Chinese supply chains. Rather than investing heavily in local R&D or building deep-tier manufacturing at home, many domestic firms found it far easier to simply import, assemble, and “label” Chinese components. This lack of industrial hunger has effectively turned sections of our manufacturing base into glorified assembly lines. While China was busy building the world’s “factory of the future,” many Indian businesses were content to play the role of middlemen. In the electronics sector, local value addition remains low at only 18-25%, despite the skyrocketing volumes of “Made in India” smartphones. India’s private sector spending on R&D remains significantly lower than that of its global peers, often under 0.7% of GDP.

Bypass Through 3rd Party

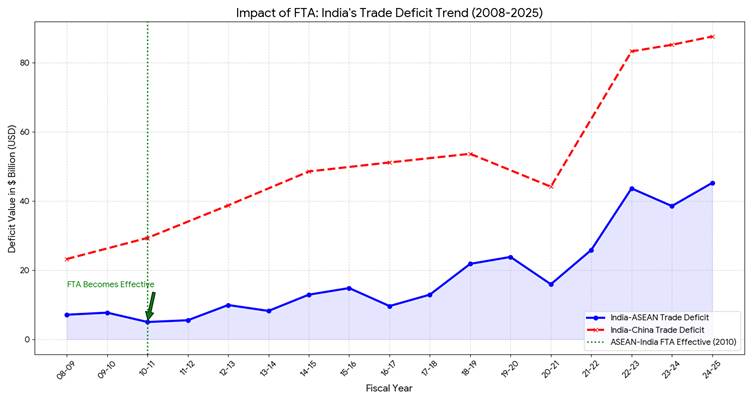

India has signed free trade or preferential trade agreements with multiple blocs like SAARC, EFTA, and MERCOSUR, and the very basic objective behind signing these agreements was very clear: it will improve trade agreements between the signatories, but there is one agreement which is not abide by this basic principle, which is the AIFTA (ASEAN India FREE Trade Agreement), this agreement should have been responsible to uplift the India and ASEAN nations trade and it has certainly did but one sided, primarily the export from ASEAN to India has increased significantly but Indian exports lagged to gain a pace in the ASEAN market, and AIFTA does not only accused of one sided trade benefit it is also accused of infringement of ethical code in its operation, AIFTA allows the moment of goods between country freely but China is also been an considerate member who is enjoying the perks of this with being a signatory of it, China is been accused of using AIFTA to enter the Indian market through backdoor and tariff free entry into the Indian market, India has raised this issue multiple times on bilateral forums about country of origin of the goods coming from ASEAN countries.

Divergence

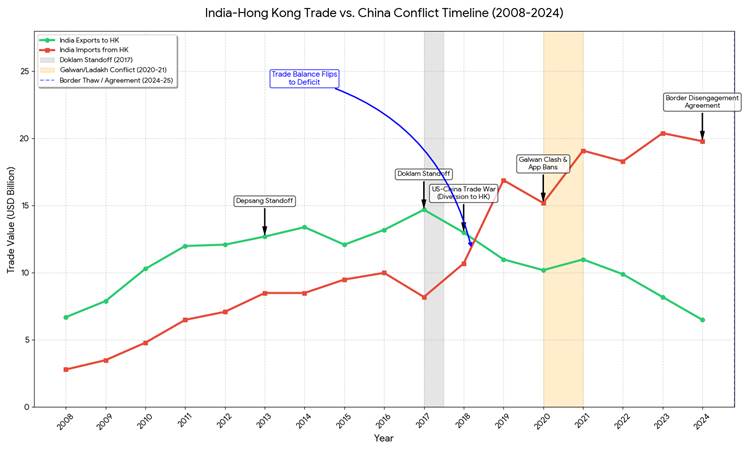

India imposes multiple trade-related duties and tariffs on China, but China is bypassing them easily through a loophole, which is known as “Hong Kong.” China follows a unique system despite being a communist state, which is “One Country, Two Systems.” For Hong Kong being under China’s administration, China has agreed to a term of one country and two system where Hong Kong and China will represent as one country but will follow 2 system at least till 2049 and after their system will also unite with each other, and this system is the loophole for the Chinese exports as Hong Kong follow and represent a different system on international level for its trade purpose also, and India is not different from world in terms of following it, India follows a separate customs territory for China and Hong Kong, where India accounts trade with Hong and China separately and apply tariff separately on the two nation so tariff applied on China does not have effect much on the Hong Kong and China uses this thing loophole to access the Indian market.

R&D Cycle

India is a nation of 1.4 billion, and for this size of population, it is not hard to generate tons of innovative idea but the problem arises at a point when we talk about converting those ideas into tangible idea with spending around 0.6% to 0.7% of their GDP around R&D, India cannot leverage its fast young thinker population, which eventually leads to brain drain and higher imports, high skilled people leave the country and migrate to foreign country for better opportunities, domestic firms find imports more efficient and profitable instead of manufacturing locally which makes the India more reliant on foreign supply chain especially on China, there is a vicious cycle which is led by the R&D cycle: low R&D leads to fewer breakthroughs, which increases imports; rising imports weaken domestic capability, which further reduces incentives to invest in R&D; and the best minds leave, hollowing out the ecosystem even more.

Chinese View on India-China Trade

If you have ever studied Chinese diplomacy, you are likely familiar with the term “wolf diplomacy.” It is a form of diplomacy in which Chinese diplomats on a global scale are responsible for protecting and enhancing the image of the Chinese government and the CCP. Additionally, wolf diplomacy has also influenced China’s trade relations with foreign countries, including India. Chinese diplomats believe that “India is benefiting from trade with China,” and they completely disregard any influence that the border or disparity situation may have on trade discussions. China holds various viewpoints regarding the trade relationship with India.

Everything is normal.

China has isolated its economic interests from the heat wave of border tensions. China is the world’s 3rd largest country in size, and shares land borders with 14 countries. China has land disputes not just with India but with 10 countries in its neighborhood, including land and sea, and yet it is the world’s largest trading country, with $6 trillion in goods and services trade. Chinese diplomats argue that the border dispute should not interfere; they believe trade is a stabilizer, and any attempt to scale the border dispute onto the trade will seriously undermine the regional value chain, raise the cost for businesses on both sides, and hinder border economic integration. In short, the more you try to resist, the harsher the environment will get on the border.

Diamond among stones.

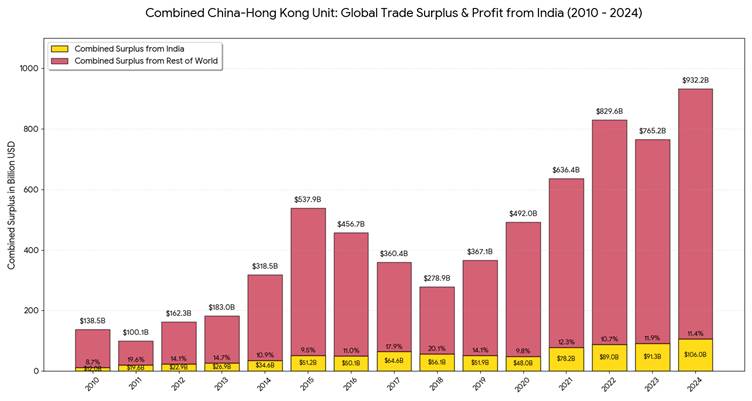

The world’s largest trading country has a global trade of around $6 trillion, and out of all its trading partners, India is placed at 16th position, and the trade volume does not even cross $160 billion, which makes it very insignificant for the trading giant, but here is the catch the volume might be small, but the impact is very high, in the bilateral trade between China and India, China enjoys a trade surplus of more than $100 billion, and the overall trade surplus China have in the trading world nearly $1 trillion, which means in trading terms India account for almost 2% in total trade but accounts for 10% of total surplus, which makes India an unearthed element which China surely does not like to provoke the trade with India

Internal Recession

China is struggling internally after the Covid era. China is known for an export-based economy, which means its GDP growth is propelled by the export of goods to other nations, such as India and America, which are known as internal consumption-based economies. Despite having an average GDP per capita of around $13,000, export-led growth propels China’s economy instead of internal consumption. China incentivizes the production units for export by providing state-backed credit, subsidized land and energy, and massive port-logistics infrastructure that makes selling abroad easier than selling at home. In contrast, domestic consumption remains relatively weak as a share of GDP due to high household savings, limited social security coverage, and income uncertainty, which encourages precautionary saving over spending. So, China strategically maneuvers its geopolitical actions to benefit from its status as a high trade surplus country.

Let Him Cook Now: India’s Counter

India is facing several challenges in the trading world, particularly from China, and while there are limited existing solutions or precautionary measures for self-defense, developing safety mechanisms cannot be considered a definitive solution to counter these threats, as any effective solution must be future-ready and sustainable.

Chuck Potion for Manufacturing: PLI (Production Linked Incentives)

By looking around in the manufacturing industry of India, you will surely notice one basic thing: “Private labeling is high, instead of value addition in the manufacturing sector.” India imports smartphone components such as batteries, lenses, and motherboards, assembles them locally, and sells the final products in the global market under the Made in India brand name, with value addition ranging from 18% to 20% for these electronic products. To address this issue, the Indian government has introduced a new incentive scheme known as the PLI (Production Linked Incentive) scheme.

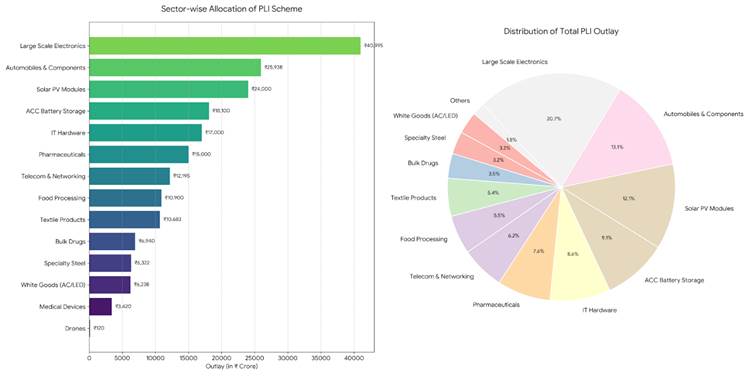

The Government of India offers the Production Linked Incentive (PLI) Scheme across 14 strategic sectors. These schemes were launched with an initial total outlay of approximately ₹1.97 lakh crore ($26 billion) to enhance India’s manufacturing capabilities, boost exports, and create global manufacturing champions.

All for One: FTA (Free Trade Agreement)

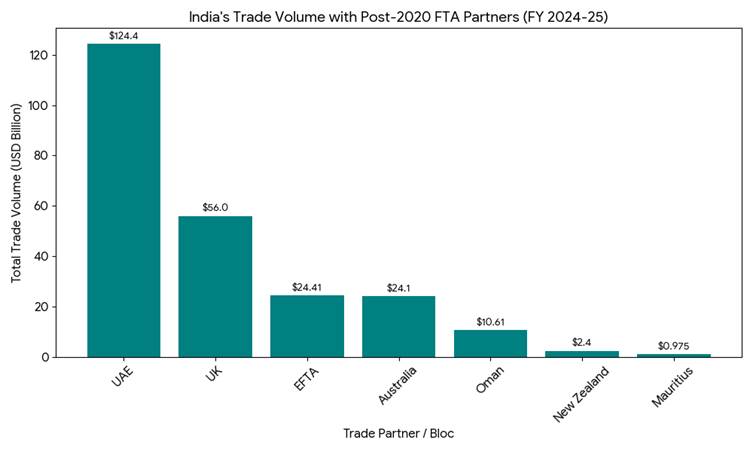

On a global scale, India is pushing the FTA (Free Trade Agreement) with multiple countries, and if you look at India’s free trade partners from 2021, it has increased, and 7 new partners have been added, and most of them are developed nations, which means, as a developing nation, having an opportunity to export is more logical. The logic behind India signing the FTA is very clear: to diversify imports and unlock new export-market opportunities, reducing overreliance on any single trading partner. By lowering tariffs, easing rules of origin, and harmonizing standards with a wider set of economies, India can source critical inputs such as minerals, components, and energy from alternative suppliers, diluting concentrated import dependence on China.

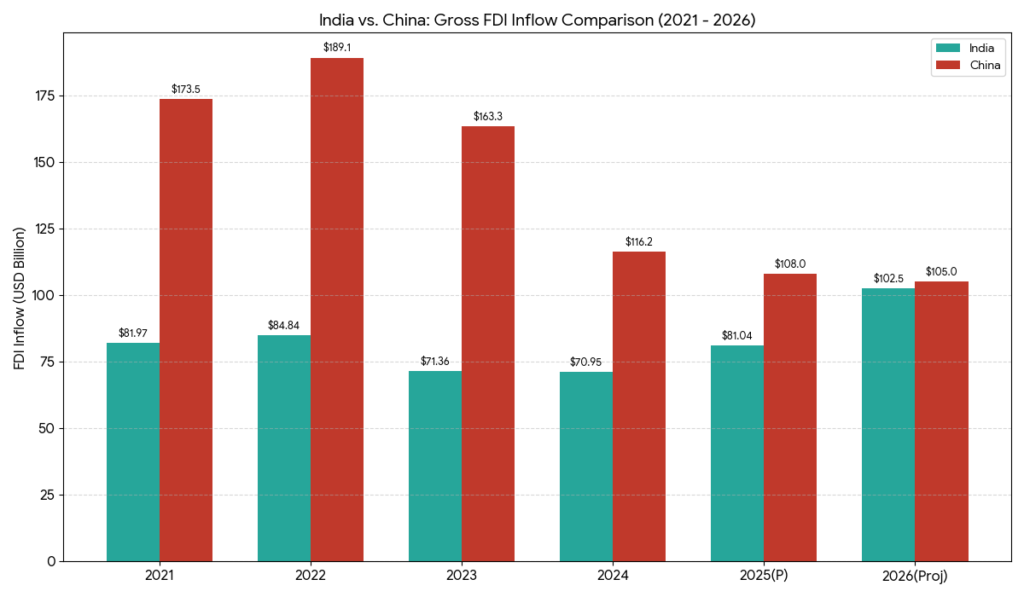

FDI Traction

If you actively listen to discussions on the global geoeconomic stage, you may have heard about the major investment news from leading companies in India. Giants like Google are investing over $15 billion in India and building AI data centers, which are the largest in Asia. Microsoft will be investing $17.5 billion in the AI and cloud computing infrastructure, and Amazon will be investing $35 billion in India by 2030 for the development of logistics and increasing local sourcing. The prospects of investment seem positive, as India is achieving a Goldilocks position in its economy and continuing structural reform.

Home Sweet Home: Domestic Consumption

In 2025, the Government of India took multiple steps to encourage domestic private consumption, counter the global slowdown, and promote in-house capacity building amid US tariffs. Some of the steps included restructuring tax slabs to ensure that individuals earning up to 7 lakhs pay no income tax, which was previously set at around 3 lakhs; reducing GST rates on high-consumption goods; lowering the repo rate by 0.25% to reach 5.25% to enhance cash flow in the money market; and introducing VB-GRAMG, an upgraded version of MGNREGA, which increases the number of working days to 150. The budget has also been increased to 1.5 lakh Cr from around 96000 Cr. All these measures will help India to improve workforce skills, produce at low cost, and promote investment locally, which reduces the chances of Chinese imports occurring in India.

Navigating the “New Normal” of Asymmetric Interdependence

The relationship between India and China in 2026 has evolved beyond a simple trade deficit; it has become a complex test of India’s economic sovereignty. As the “frozen border and warm balance sheet” reality persists, India’s path forward is not about an abrupt decoupling, which would be industrially suicidal, but about a sophisticated “de-risking” strategy.

The real challenge for India is not the trade deficit itself, but where that deficit comes from. Policy tools like PLI schemes, FTAs with diversified partners, and FDI inflows are early steps toward reducing single-country dependence. Factories can be built, and tariffs can be imposed, but without a strong R&D ecosystem, India will remain structurally dependent. If India wants leverage in trade negotiations with China, it must first build technological depth at home

Unlike China’s export-led model, India’s strength lies in its vast domestic consumption. Recent tax reforms, credit easing, and employment schemes are not just welfare measures; they are strategic tools to anchor growth internally. A strong consumption base affords India bargaining power, resilience against global shocks, and a cushion against coercive trade tactics.

The future of India–China trade will not be defined by slogans like “boycott” or “decoupling,” but by calculated balancing. India must continue trading with China while quietly building alternatives, strengthening domestic manufacturing, and investing in innovation. In geopolitics, distance creates hostility, but in economics, preparedness creates leverage. India’s goal is not to stop trading with China, but to ensure it never trades from a position of vulnerability.