The American economy, A behemoth, is failing. For two centuries, it was the uncontested global behemoth, a fortress of global capital and innovation. Now, the cracks are widening. Worn by foreign rivals, destabilized by internal division, and crippled by the very policies designed to keep it dominant, the giant is stumbling. We all see the endpoint, but the world wants an autopsy: How is the American economy dwindling?

Strategic Placements

The Birth of Behemoth

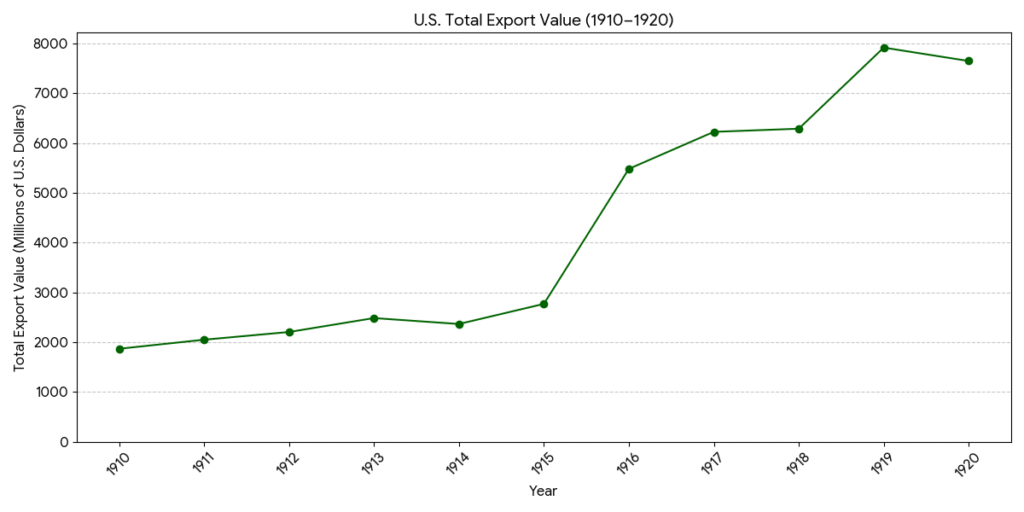

America’s late entry into both World War I and World War II became a major turning point for the American economy. While the U.S. stayed neutral in the early stages of both wars due to domestic priorities and its isolationist stance, European Allied powers, especially Britain and France, became heavily dependent on the American economy. They relied on the U.S. for food, weapons, steel, machinery, clothing, and essential wartime supplies.

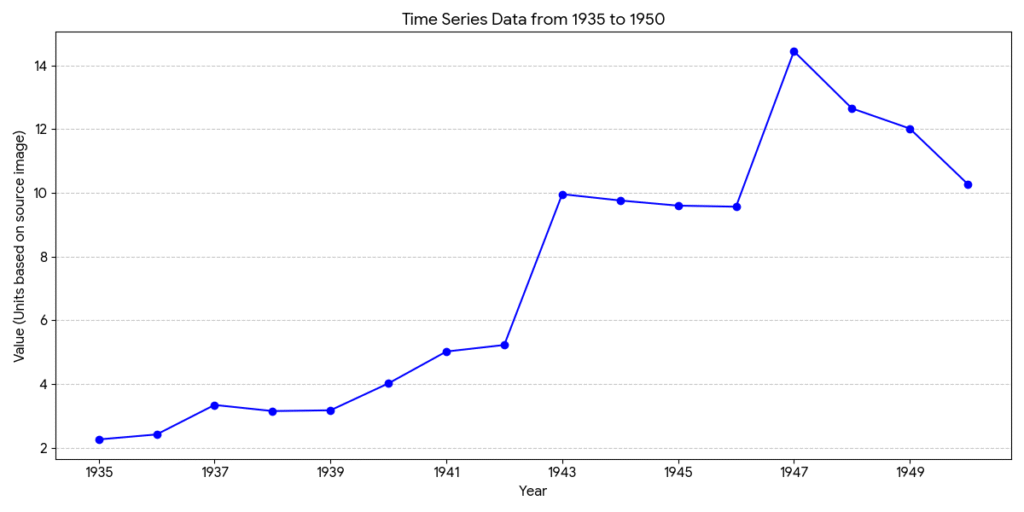

During World War I, the U.S. government lent nearly $10.1 billion to Allied nations between 1917 and 1920. After the war, it introduced reconstruction programs like the Dawes Plan and Young Plan, injecting another $4 billion into Europe between 1924 and 1930. The pattern repeated in World War II. Under the Lend-Lease Act, America provided over $50 billion in aid between 1940 and 1943. After the war, the Marshall Plan added another $13 billion to rebuild Europe.

The fact that former colonial superpowers now relied on the U.S. for money and resources signalled a clear shift in global economic power, and increased dependence on the American economy can be understood by below export data of the US.

Bretton Woods Agreement: from Neonatal cry to burial in Oil

As U.S. exports surged and its budget expanded, this dominance laid the foundation for the Bretton Woods system established in 1944. With the world economy in ruins, the U.S. emerged as the only stable superpower. Bretton Woods pegged the dollar to gold at $35 per ounce, and other countries pegged their currencies to the dollar. Many nations stored their gold in the U.S. and used dollars for global trade. The system also created the IMF, World Bank, and WTO to stabilize global finance and trade.

However, excessive U.S. money printing during the Vietnam War weakened the dollar and eroded trust in the American economy. In 1971, President Richard Nixon ended dollar-gold convertibility, known as the Nixon Shock, collapsing Bretton Woods. To maintain dollar dominance, the U.S. struck deals with major oil producers, especially Saudi Arabia, making the oil trade exclusively dollar denominated. This created the “petrodollar” system, securing the dollar’s position as the world’s leading currency and also securing the American economy at the top.

Seed Capital of Problems

The US has over the period has faced multiple problems from its very period, whether matters related to its expansion from 13 states to 50 states, Indigenous peoples’ resistance, black people’s rights, civil war, Anti-Trust laws, Terrorism and even cold war has not made American economy to bow down, but when you breathe the geopolitical situation in the First Quarter of 21st Century you can eventually see the mighty American Eagle is surely struggling flap its wing.

Once upon a Time in 1990

The current weathenress of the American economy could sense its origin roots from 1990 onwards when the US was enjoying the win of Capitalism and Democracy over Socialism and Communism.

At the end of 1991 Soviet Union finally collapsed, and America was crowned as the sole military power, and it has changed the global Geopolitical and Geoeconomic landscape completely

open markets, global free trade, and deals like NAFTA and the expanded WTO would lift everyone. But the turning point came in 2001 when China joined the WTO. American companies rushed to shift factories and supply chains overseas, chasing cheaper labour and higher profits, which American economy could not provide clearly. What looked like smart business on paper slowly began tearing apart the heart of America. Manufacturing towns in the Midwest and Northeast, which were once full of stable jobs, tight-knit communities, and a strong middle class, had started to crumble. Factories shut down, low-skilled workers lost their lifelong careers, and entire regions faced wage stagnation and shrinking opportunities. Yes, Americans got cheaper products at Walmart, but the real cost was paid backstage by the families who watched their livelihoods disappear. As the economy moved toward finance, tech, and services, inequality deepened, leaving many with feelings of abandonment by a system and once American economy that promised prosperity for all but delivered it only for a few.

As the American economy faded with mass manufacturing, Wall Street stepped into the spotlight, and the economy drifted into what many call “financialization,” it states a system where financial profits mattered more than real production. The repeal of the Glass-Steagall Act in 1999 removed the barrier between everyday banking and high-risk investment activities, turning the financial sector into something resembling a giant Las Vegas casino. Banks piled on debt, created complicated and stupid financial products, and pushed risky subprime mortgages onto millions of families who simply wanted a home. These products, especially derivatives like CDOs, looked sophisticated, but they were built on extremely shaky ground. Eventually, the bubble burst in 2008, unleashing the “Great Financial Crisis” on the world and the American economy. Suddenly, the entire system that had appeared unstoppable was exposed as dangerously vast but fragile. The government stepped in with massive bailouts to save big institutions, while ordinary Americans faced foreclosures, job losses, and years of slow recovery. Students carried crushing debt, families struggled to rebuild, and public trust eroded. Many felt the system and American economy had made its priorities painfully clear: big banks were “too big to fail,” but everyday people were not deemed too important to be saved.

After 9/11, America’s response was extensive and brutal in the form of the “War on Terror”, which pushed the American economy even deeper into debt. The wars in Afghanistan and Iraq were fought on borrowed money, and tax cuts during the same period meant the government was spending far more than it was bringing in. But unlike the post-World War II era, when debt helped build highways, universities, and opportunities through programs like the G.I. Bill, this new wave of debt produced little long-term growth in the American economy. Much of it went into military operations and maintaining a vast global security presence, partly to uphold the petrodollar system. Today, the national debt has surged past “$34 trillion,” and rising interest rates make the burden even heavier. A growing portion of the federal budget now goes just toward paying interest, the money that could have strengthened roads, schools, healthcare, or future innovations. Instead, it’s locked away, servicing past decisions. This creates a slow squeeze on America’s future, limiting the nation’s ability to invest in what truly drives prosperity and leaving many to wonder whether endless borrowing for short-term goals is quietly undermining the American economy’s strength.

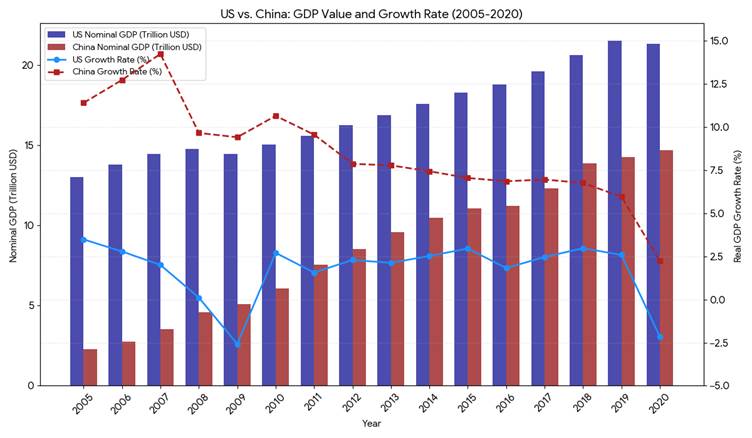

The final factor in America’s gradual decline is the slow erosion of the external advantages it once took for granted. Emerging economies, especially China, which has built formidable strength using a communist-capitalist model, mastering large-scale manufacturing, investing heavily in mega infrastructure, and pushing aggressively into advanced technologies like AI, 5G, and electric vehicles. Where the U.S. once stood unchallenged, it now faces a direct competitor capable of matching or even surpassing it in key industries.

At the same time, America’s heavy use of financial sanctions against countries like Russia and Iran has made many nations uneasy about relying on a dollar-dominated system. The growing perception that the U.S. can “weaponize” the global payment network “SWIFT” has accelerated a push toward de-dollarization, with countries increasingly exploring trade in local currencies or building alternative payment platforms through groups like BRICS. Even a small global shift away from the petrodollar threatens long-term American economy stability: it would raise borrowing costs, weaken demand for U.S. debt, and expose the economy to a harsher adjustment of its persistent trade deficit. Together, these trends signal a world where America’s automatic advantages are no longer guaranteed.

The following section illustrates how China is catching up to the giant American economy with the help of its manufacturing sector and appropriate policies.

Cremation of Bald Eagle: Just A Formality

The American economy can also be referred to as the bald eagle, who flies above the clouds of rain and thunder, which has always given it an edge and comfort for a very long time. When the eagle begins to become old, it experiences the same wind and storm that other animals face.

The American economy is trying to find hope in various things, which are proving to be more harmful than giving some relief due to various reasons, such as lack of unity among decision maker, short-sightedness among the primary beneficiaries

The American economy is desperately in search for the next breakthrough in specific industries like AI leadership, reshoring manufacturing, clean energy revolutions, but these strategies require unity, long-term planning, and fiscal discipline. Instead, the American economy is trapped between political polarization, skyrocketing debt, shrinking global trust, and a rapidly advancing set of rivals who have learned from America’s playbook and optimized it for their own rise.

China and other emerging economies is no longer catching up, it is competing head-to-head with the American economy. BRICS nations are no longer spectators; they are building parallel systems. Allies are no longer dependent; they are hedging bets. And the world is no longer willing to accept American leadership as a default setting.

The eagle is not dead, but it is exhausted. Its wings are heavy, its feathers worn, and its sky is getting more crowded than ever more competitive than ever. The cremation is not the end of America, but the end of an era where its dominance went unquestioned. What comes next will depend on whether the eagle adapts to the new winds or is remembered only for how magnificently it once flew.