China, a 5000-year civilization shaped by conquest, communism, protests, and relentless reform, transformed itself from famine-era collapse to the world’s second-largest economy. Yet the very model that fuelled its rise is now sponsoring state-heavy investment, property dependence, demographic decline, and debt-driven growth has become a burden. The “economic dragon” is turning into a costly “white elephant”, exposing structural cracks that now threaten China’s long-term stability and challenge its once unstoppable momentum.

China’s Economic Leap: Rise of the Red Dragon

Mao Zedong to Deng Xiaoping: Resistance to Reform

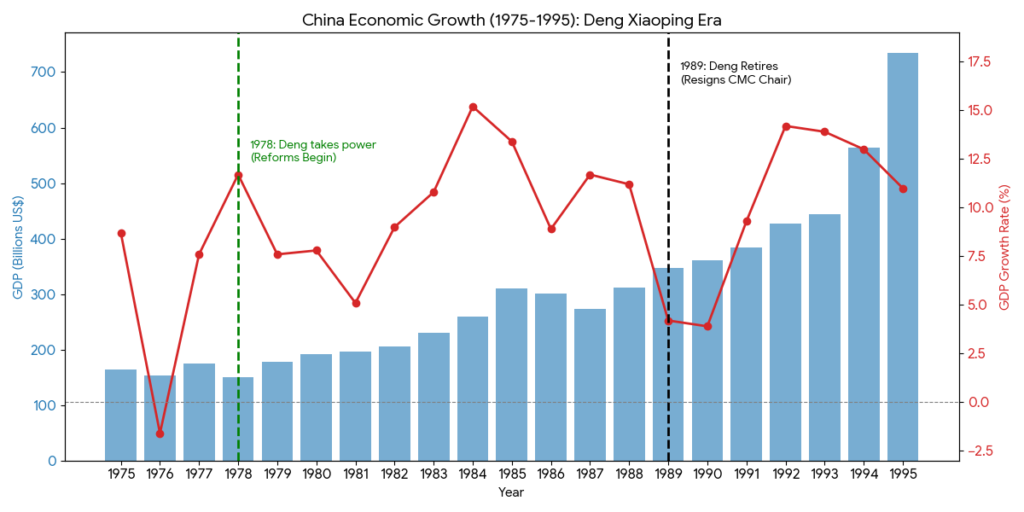

In 1976, Mao Zedong passed away due to his long-time partner Parkinson’s disease, and 27 years back, horror came to haunt all whole China once again, which was none other than “Power Struggle”, and for the next 2 years CCP (Chinese Communist Party) faced high internal strife for power and from this churning a new leader emerges whose name was “Den Xiaoping” father of Modern developed China.

Deng Xiaoping decided not to be the successor of Mao Zedong’s weird economic theory but chose to build a new China whose economic prosperity would last decades after his death. He introduced multiple reformist policies in the next term of 11 years, introducing decentralization of power from the central authority to provincial establishments, giving more power to the state-owned enterprise by giving authority to manage production to the factory manager for production, dismantling the commune agriculture, and allowing individuals to decide about their farm.

allowing the participation of private enterprise in the economy under the socialist model, emphasizing more on the development of skilled comrades, opening the economy for the international market by establishing SEZs across China, establishing the Stock Exchange market, and most importantly, establishing economic relations with the world’s largest economy, America.

China recorded this decade as the “Reform and Opening Up.” From looking above to this policy, you will surely think that this economic reform will last long and will surely improve the economic conditions, but under this calm development, there was a little calf taking birth, which will come after 4 decades, and through its dance, it will curse China.

Real Estate: from Piles of Dirt to a Piece of Gold

We all know the 4 basic components to start a business are land, labor, capital, and entrepreneur. Here in the Chinese case, the entrepreneurs were the central government, provincial government, and the factory manager; capital was infused by the government, and an abundance of labor was already there; now remains the game of land, in China, land is owned by the state means any non-governmental entity, like private households, private Industries cannot own land in China and this became hinderance in the development.

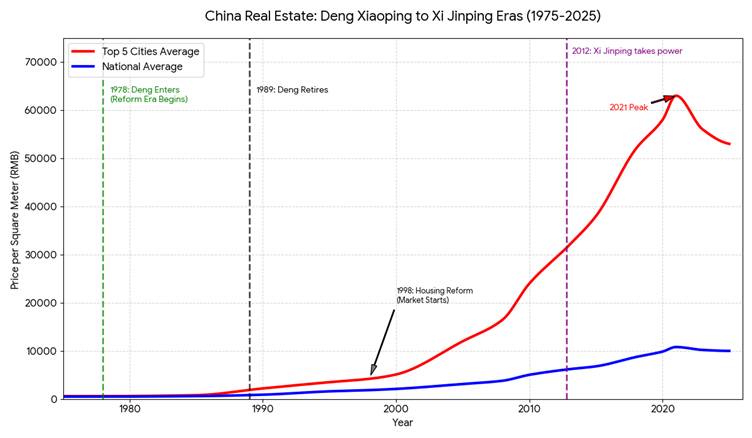

before 1988, there was no “real estate market” in China. You couldn’t walk into a sales office and buy a condo because condos didn’t exist. You see, till 1988, all the land in China belonged to the government, and the government made sure that you got a house. In urban areas, houses are provided by your employer (Ex, state-owned enterprises, Govt agencies & institutions), and in rural areas, the village leader will decide where comrade will build their residence. In simple terms, you will own bricks and cement, but not the land, but the status changed in 1988.

Government of China in 1994 allowed the leasing of land to non-government entities such as private households and industries. The estate still owns the land, but the right to build or use it has been sold off for a specific period. You don’t own the land, but you can buy a 70-year ticket to build a house on it and live there.

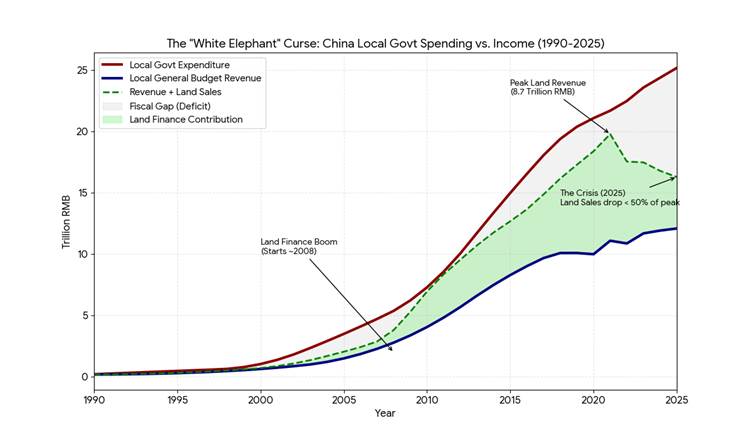

In 1994, this process of land reform got further strengthened as the provisional government needed more funds for its operation. The Central Government took most of the tax money for itself but told Local Governments, “You still have to pay for roads, schools, and bridges.” As a result of paying the bills, they started selling those 70-year land rights to developers at huge prices. This is called Land Finance. It became their main source of income.

The real reform in real estate came in 1998 when the government told the companies to stop giving free accommodation to the employees, the very specific reason why China did this was because of 1997 Asian financial crisis was triggered and all the major Asian economy like Malaysia, Indinesia has started facing stagnation, which created a havoc in the Chinese economy as China was exporting cheap goods to these economy and building its own growth path, to uplift the economy from this crisis China needed its own people to start spending huge amounts of money inside the country to keep the economy moving. The solution they found was a House.

The government gives the workers 3 options,

The very first option was to take a loan from banks and buy a house, and a fixed percentage of income will be deducted from your salary.

The second option was to offer the dorm to the already living worker at a peanuts rate based on their seniority and ranking.

The very last option was to offer the land to developers at free of cost and tell them to develop land at cheap price and sell it at very cheap rate.

This decade of reform has resulted in an explosion of demand in the housing demand and the emergence of the real estate market and the birth of a 1/5th GDP contributor.

Circular Disaster for the Economy

Government Push

Imagine you are a local CCP official in a small province. You have a meager budget, but the Central Government has handed you a high national GDP growth target of 5%. Your career advancement depends on hitting this number, but there is a catch: you are legally forbidden from taking direct debt from the market to fund development. So, how do you build bridges with empty pockets?

This dilemma gave birth to the LGFV (Local Government Financing Vehicle). Think of it as a shadow company created solely to bypass the rules.

Here is how the magic trick works: The local government leases public land to its own LGFV. The LGFV then uses this land as collateral to get a massive loan from a state-owned bank. With this fresh cash, the LGFV launches ambitious infrastructure projects such as highways, stadiums, and industrial parks. Construction booms, GDP spikes, and you, the official, get promoted for “economic excellence.”

But this model has a fatal flaw. It relies on the assumption that these projects will generate enough tax revenue to pay back the loans. Many were built in remote areas with zero demand. When the government builds infrastructure for people who don’t exist, the returns never come. What remains is a mountain of hidden debt and “White Elephant” projects that cost millions just to build but generate no revenue.

Companies Pull

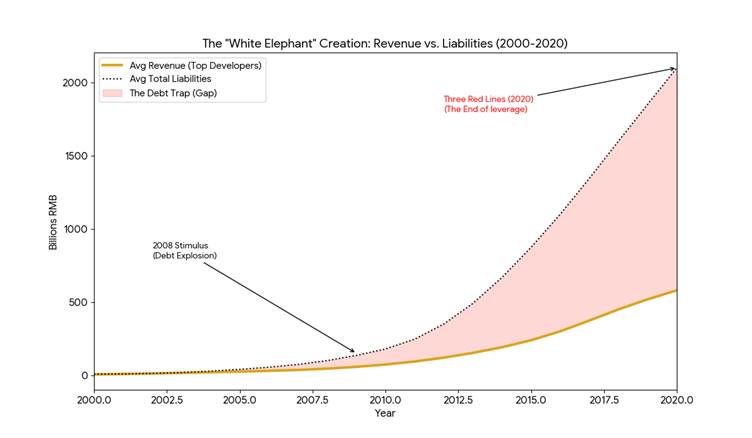

While the government was building empty bridges, real estate developers were playing an even riskier game with residential housing. They invented a cycle of debt that functioned almost like a Ponzi scheme.

Major developers didn’t just build homes; they manufactured cash flow. They would take a loan to buy land and immediately pre-sell the apartments before a single brick was laid. But instead of using that money to finish the project, they diverted the funds to buy new land and start new projects.

Why? Because in a booming market, size was everything. To pay off old debts, they needed to get bigger to qualify for new loans.

Step 1: Borrow money to buy Land A

Step 2: Pre-sell apartments on Land A

Step 3: Use the cash from buyers + new loans to buy Land B (leaving Project A unfinished)

Step 4: Repeat

This “high churn” model created an illusion of massive success, but it was built on a foundation of ever-increasing debt. If housing prices went up and banks kept lending, the music played. But the moment the market slowed, the cash flow stopped. Now, developers are left with billions in debt they can’t pay and millions of “rotting” unfinished homes that buyers have paid for but may never live in.

This dual-engine failure, which was local governments drowning in LGFV debt and developers collapsing under their own leverage, has created a perfect storm. The “growth at all costs” mentality has finally sent the bill, and China is finding it too expensive to pay.

The economy was calm until you arrived….

Fatigue

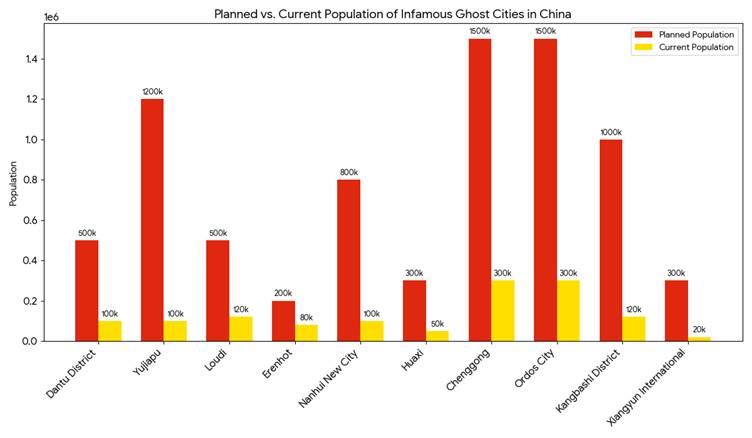

Infrastructure relies on public investment when people buy homes, offices, and retail space. However, this cycle depends on demand, a fundamental reality that local government ignored. Instead, they relentlessly built “White Elephants.”

High-cost skyscrapers, residential complexes, and high-speed rail networks were built on barren land, disconnected from actual needs. These projects now stand empty because the market is saturated. The public has already sunk their savings into earlier developments and simply lacks the liquidity to invest in these new, remote properties. The government built a supply for a demand that no longer has the cash to show up.

The properties that were turned out to be unpurchased, known as ‘Ghost Cities’ or on a larger scale, turned out to be ‘White elephants.’ Many cities in China turned out to be ‘White elephants’, as shown below.

This gap between the Red Bar (Government Ambition) and the Yellow Bar (Reality) is where the “White Elephant” curse truly lives. It represents trillions of yuan in concrete that generates no economic return.

If people are not buying houses, then we can surely conclude that all the public necessity infrastructure, such as trains, metros, roads, malls, hotels, and motels, is also unused, and the impact is not limited to here only; it extends far beyond our imagination.

3 red lines

The fatigue of Chinese citizens was mounting and was showing its impact, but the CCP thought “Naa it should be more firyy”, so the CCP introduced a new law related to the real estate industry.

In August 2020, Beijing decided the party was over. Worried that the property sector’s massive debt posed a systemic risk to the entire economy, the central government introduced the “Three Red Lines” policy. The goal was to force aggressive developers to deleverage and stop using borrowed money to fuel endless expansion. It was a strict ultimatum: get your finances in order, or we cut off your credit. This policy marked the end of the era of unbridled growth and triggered the liquidity crisis we see today.

To borrow more money, developers had to meet three specific financial health metrics.

First, their liability-to-asset ratio had to be less than 70% (excluding advance proceeds from pre-sales).

Second, their net gearing ratio (debt compared to equity) could not exceed 100%.

Third, they had to hold enough cash to cover all short-term debt (a cash-to-short-term debt ratio of more than 1).

If a developer crossed all three “red lines,” they were banned from raising any new debt.

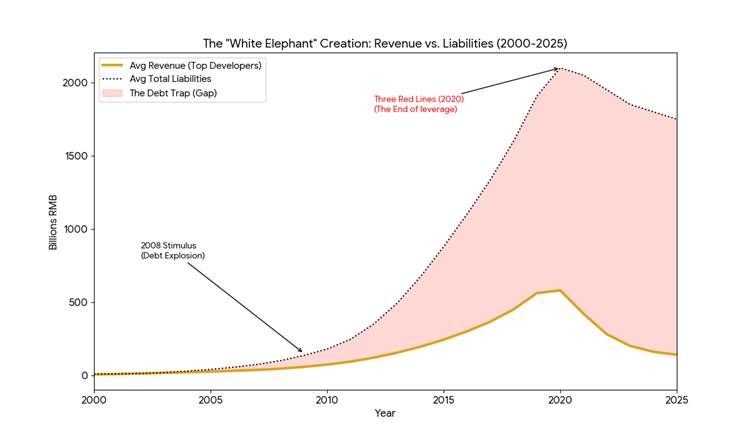

The impact was immediate and catastrophic for high-churn giants like Evergrande. Classified as “Red” violators, they were suddenly cut off from the fresh loans they needed to pay old debts and finish construction. This triggered a liquidity crunch that rippled through the entire sector. Unable to borrow, developers couldn’t pay suppliers or deliver homes, leading to a loss of public confidence. The policy successfully stopped the debt binge, but in doing so, it exposed the fragility of the entire real estate model.

The House of Cards Called Prosperity

In 2021, the pace of catching fatigue and the 3 red lines crossed each other, they popped the bubble and shattered the ecosystem that kept the Chinese economy at cloud 9.

The Suppliers, such as cement suppliers, steel bar producers, and painters, were the first to feel the pain. Developers like Evergrande often paid suppliers not with cash, but with “commercial acceptance bills” (essentially, I-O-Us). When the liquidity crunch hit, these bills became worthless paper. It is estimated that suppliers are owed over ¥1 trillion ($140 billion) in 2021 in unpaid bills. Thousands of small businesses have gone bankrupt because their “safe” invoices turned into bad debt overnight.

For Chinese citizens, real estate isn’t just a home; it is their primary savings account. About 70% of Chinese household wealth is tied up in property (compared to 30% in the US). Millions of families prepaid for homes that are now “rotting” unfinished. They are stuck paying mortgages on apartments they cannot live in. As prices fall (dropping 20-30% in some tier-2 cities), the “wealth effect” has reversed, now people feel poorer, so they stop spending, deepening the economic slowdown.

State-owned banks fuelled this expansion, believing the government would always bail them out. Now, they hold the bag. Official data claims bad loans are low, but analysts estimate that nearly 40% of bank loans are tied to property. As developers default, banks are forced to tighten lending, starving other healthy industries (like tech, AI, and manufacturing) of the capital they need to grow.

International and domestic investors who bought high yield “junk bonds” from developers have lost billions. Offshore dollar bonds from Chinese developers have lost over 90% of their value. The trust that global investors once had in the “Chinese Growth Story” has evaporated, leading to massive capital flight.

This is the ultimate irony. Local governments relied on selling land to fund their budgets (Land Finance accounted for 40% of local revenue). With developers broke, land sales have plummeted by over 50% in many provinces. Local governments are now drowning in debt (LGFV debt is estimated at $9 trillion) and can no longer afford to maintain the very “White Elephant” infrastructure they built to boost their GDP.

Can Dragon protect itself from White Elephant curse?

Faced with a collapsing house of cards, Beijing knew it could not simply let the “White Elephant” curse hit the economy. In 2020 and 2021, the central government launched a desperate series of moves to delay the catastrophe and buy time to find a sustainable solution.

To prevent a social uprising from millions of angry homeowners, the central government quietly guided state-owned banks to delay mortgage collections of $220 billion and relax terms for struggling developers. This wasn’t a solution but a medically induced coma for the banking system. The goal was to prevent immediate mass defaults while forcing developers to prioritize finishing stalled projects rather than paying back investors.

Recognizing that local governments were drowning in hidden LGFV debt, Beijing initiated a massive debt swap program. They allowed local governments to issue “special refinancing bonds,” which essentially means turning high-interest, short-term shadow debt into lower-interest, long-term official government bonds. This didn’t erase the debt ($9 trillion is too big to erase), but it moved it from the “emergency room” to “long-term care,” preventing a cascade of municipal bankruptcies.

If you can’t build more bridges in Jiangsu, why not build them in Jakarta? China accelerated its push to export its overcapacity through the Belt and Road Initiative. By lending money to developing nations to hire Chinese firms for infrastructure projects, Beijing tried to keep its massive state-owned construction giants alive and working, even as domestic demand dried up, while subsequently moving their core business from construction to other sectors.

China’s “White Elephant” curse is far from over. The interventions of 2021 were tourniquets, not cures. The “Economic Dragon” has avoided a sudden heart attack, but it now faces a long, slow rehabilitation. The era of double-digit growth fuelled by concrete is dead. The question now is whether China can endure the painful withdrawal symptoms long enough to build a new economy based on consumption and technology, or if the weight of its past excesses will keep it trapped in the stagnation of a “lost decade.”

Pingback: Frenemies of Commerce: The Paradox of India-China Trade Relations - Sorted Views